by Columbus Realtors with additional content by Errol Butcher

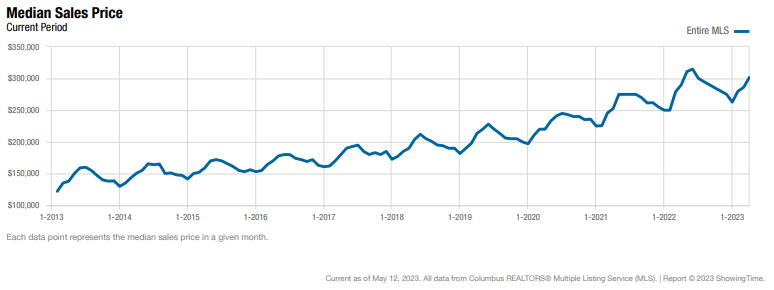

Median Sales Price Tops $300,000

For April 2023, the median sales price in central Ohio rose above $300,000 for the first time since July of 2022 in the latest housing statistics for April 2023 from Columbus REALTORS®.

For April 2023, the median sales price in central Ohio rose above $300,000 for the first time since July of 2022 in the latest housing statistics for April 2023 from Columbus REALTORS®.

The median sales price rose 4% year-over-year and 5.5 percent month-over-month. This is only the fourth time that the median sales price has crept over the $300,000 mark since statistics began being tracked by Columbus REALTORS®. The other three occurrences were in May of 2022 ($310,830), June of 2022 ($315,000), and July of 2022 ($300,563).

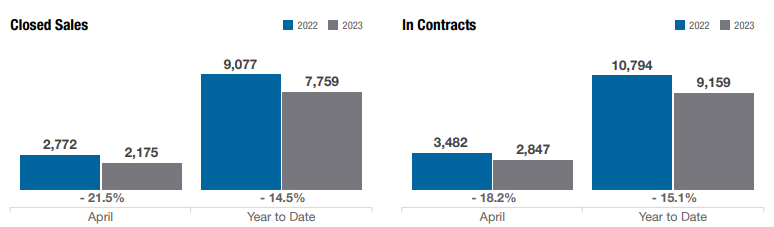

Year-Over-Year Decrease

There were 2,175 closed sales in April, a 21.5% decrease year-over-year and a 5.6% decrease compared to March.

“May of 2022 was right about the peak of the market in central Ohio. At that time last year, we had even less inventory than we do right now, and homes were selling in 13 days,” recalled Columbus REALTORS® President Patti Brown-Wright. “We know that mortgage rates are higher, but the housing market in central Ohio is still very much in-demand.”

Strong Demand / Low Inventory

In April, the average number of days on the market dropped to 24. In March, homes averaged 34 days on the market. The percentage of the last list price received also ticked up to 101.1%. Last year, at the market’s peak, homes sold for nearly 5% over asking.

“Inventory is playing a big part in all of this,” noted Brown-Wright. “A balanced housing market requires about 5-6 months of inventory. We have less than a month of inventory, so central Ohio remains a strong seller’s market.”

Inventory Driving Prices Up

In April, the average number of days on the market dropped to 24. In March, homes averaged 34 days on the market. The percentage of the last list price received also ticked up to 101.1%. Last year, at the market’s peak, homes sold for nearly 5% over asking.

“Inventory is playing a big part in all of this,” noted Brown-Wright. “A balanced housing market requires about 5-6 months of inventory. We have less than a month of inventory, so central Ohio remains a strong seller’s market.”

Interest Rates Play a Part

Rates on a 30-year fixed mortgage hovered slightly over 7% in April, and according to statistics from the Central Ohio Regional MLS, 20% of all closed sales in April were cash sales, while 65% were conventional mortgages and 16% were government-backed loans.

Local Spotlight

In the local market spotlight, homes in the Dublin Local School District (LSD) covering Franklin, Deleware and Union Counties saw just 73 closings in April versus 119 in 2022, a 38.7% drop year-over-year. For the year, the market is down 23.5% with just 250 homes sold versus 350 in 2022. Predictably, the average price, $523,659, and median , $435,000, prices were both up in April compared to last year. Along with the price and interest increases, days on market expanded from 8 days to 19 days.

Homes in the Hilliard CSD School District (CSD) covering Hilliard and parts of Prairie Township saw just 97 closings in April versus 109 in 2022, an 11% drop year-over-year. For the year, the market area is down 10.8% with just 298 homes sold versus 334 in 2022. Predictably, the average price, $378,706, and median , $385,000, prices were both up in April compared to last year. Along with the price and interest increases, days on market expanded from 5 days to 13 days.

Homes in the Hilliard CSD School District (CSD) covering Hilliard and parts of Prairie Township saw just 97 closings in April versus 109 in 2022, an 11% drop year-over-year. For the year, the market area is down 10.8% with just 298 homes sold versus 334 in 2022. Predictably, the average price, $378,706, and median , $385,000, prices were both up in April compared to last year. Along with the price and interest increases, days on market expanded from 5 days to 13 days.

Homes in the South-Western City School District (CSD) covering Franklin and Pickaway Counties and including Grove City and Galloway saw just 116 closings in April versus 187 in 2022, a 38% drop year-over-year. For the year, the market area is down 17.4% with just 476 homes sold versus 576 in 2022. In a reverse to many of the areas markets,, the average price, $303.159 fell 2% compared to April of 2022. Median price rose to, $287,950, prices rose 4.7% in April compared to last year. Along with the price and interest increases, days on market doiubleed from 14 days to 28 days.

Marion saw a 19% increase in closed sales (50). The average sales price in Marion was $165,667, roughly half the cost of the average sale price in central Ohio. Big Walnut LSD in Sunbury also saw a 50% rise in closings as their average sales price climbed 16.2% to $533,230 in April. Of the 2,175 closings in central Ohio, 54% occurred in Franklin County, where the average sale price increased 2.5% to $340,434.

About Columbus MLS

Columbus REALTORS® is composed of almost 10,000 real estate professionals engaged in residential and commercial sales and leasing, property management, appraisal, consultation, real estate syndication, land development, and more.

The Columbus REALTORS® Multiple Listing Service (MLS) serves all of Franklin, Delaware, Fayette, Licking, Madison, Marion, Morrow, Pickaway, and Union Counties and parts of Athens, Champaign, Clark, Clinton, Fairfield, Hocking, Knox, Logan, Muskingum, Perry, and Ross counties.

Here for You

If you are considering selling your home or looking for your next, I can help! To request a free complete guide to selling your home or a competitive market analysis click here. To find available homes by school district, click here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

A major investment

A major investment